Zinance

Zinance offers a comprehensive financial-education app helping GenZ to gain financial knowledge with engaging learning experience.

Describe the specific problem that you’re trying to solve. What is the scale of the problem in your community?

1. Low financial literacy score

- Vietnam has 6.1 million people with no financial literacy. For Gen Z, the average score on financial literacy is 5.1/12 (Yen N., 2020)

2. Country’s prosperity

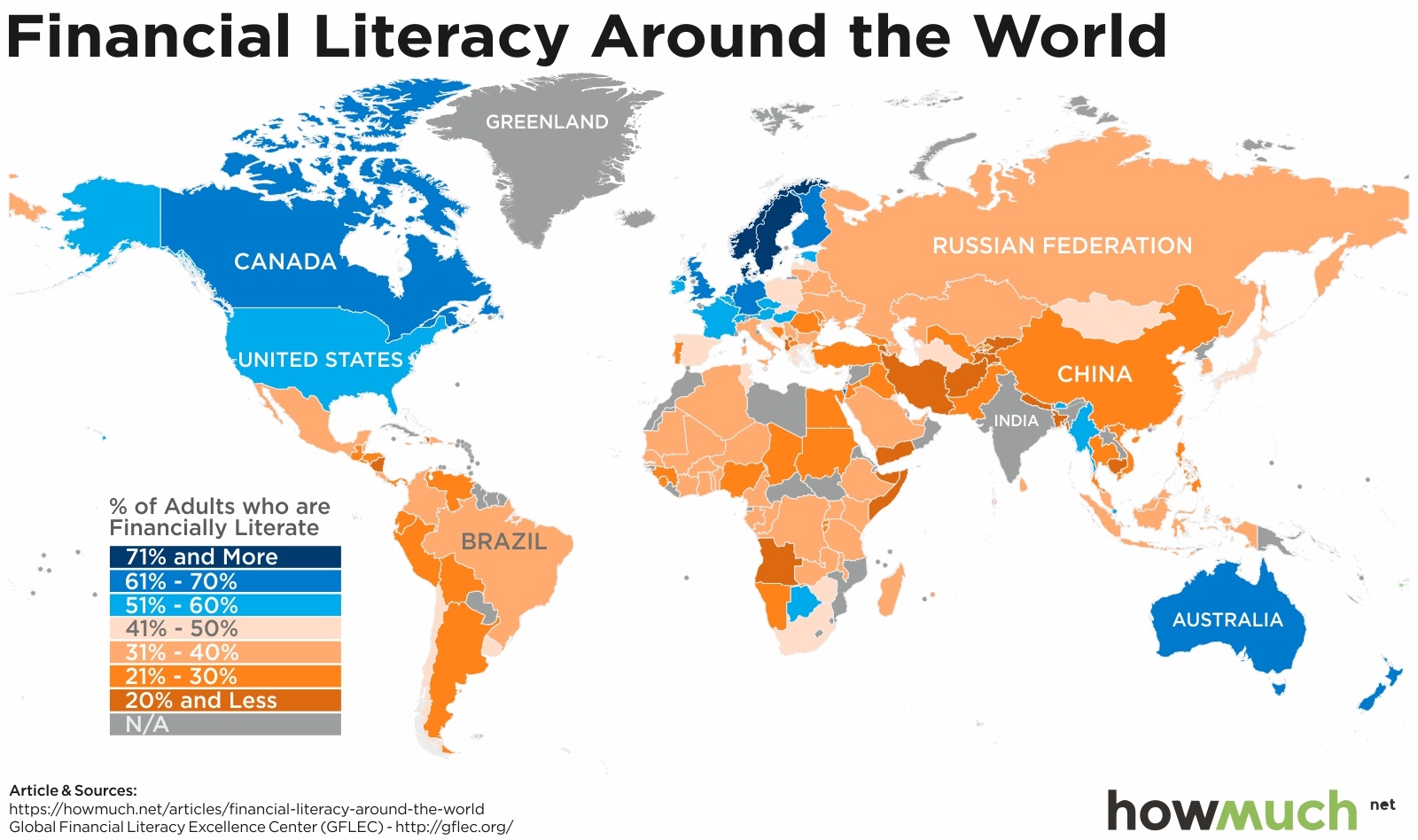

- From the socio-economic perspective, the level of financial literacy is closely related to the development of a country. (S&P Global FinLit Survey, 2014). Research clearly shows the close relationship between the financial literacy index and the overall development of each country, specifically developed countries such as Canada, the US, and Australia have a very high level of financial literacy, but The story is completely opposite for developing countries (including Vietnam).

Financial Literacy Around the World

3. Financial fraud

- Financial literacy can help protect individuals from becoming victims of financial fraud, a type of crime that is becoming more commonplace. (Investopedia, 2022)

How many people are affected?

In Vietnam, there are 6.1 million Gen Z who are not financially literate.

What factors are contributing to the problem in your community?

- Difficulties in learning about finance for the following reasons:

Gen Z doesn't know where to start to learn finance due to too many online resources

Expensive costs from formal finance courses

Limited in how to impart financial knowledge (mostly traditional lectures) → easy to lose interest and boredom for learners

Unable to apply the knowledge learned because it takes a long time to reach financial literacy

Lack of support from government

There are no regulations for schools, universities or financial institutions to provide financial education for children/adolescents.

Lack of combination of broad-based functional interventions and targeted programs for vulnerable groups (e.g., women, youth, the elderly, and SMEs)

What consequences result from the problem?

- A person with financial well-being has 1.8 times more opportunities than the other with no financial understanding. → They miss themselves a great opportunity on the road to independence and financial freedom

- The data also clearly show that the financial literacy index directly affects the GDP per capita of a country (Vietnam has a financial literacy rate of 24%). Additionally, the average salary of Vietnamese ($300) is 7 times lower than the world (regional workers ($1,992) and the world ($2,114).

- The premise for financial crime:

Vietnam has the highest number of frauds through the banking system in Southeast Asia in the first two quarters of 2022 with a total of 56,392 cases.

Vietnam is the country with the second highest number of fraud cases through the payment system in Southeast Asia in the first two quarters of 2022 with a total of 170,821 cases (ranked first by the Philippines with 238,111 cases).

Zinance equips Vietnamese young people with comprehensive financial knowledge through gamification and learn-to-earn model to turn arid financial knowledge into close and friendly to young people. Finance lessons are divided into many parts: investing, saving, borrowing, spending, earning, ... Each module is divided into many small (bite-size) lessons to help users gain financial knowledge in a systematic way.

Zinance’s mission:

Our mission is to innovate financial education for Gen Z and optimize the bank's customer acquisition process (*). As 1 of 4 pillars of national financial inclusion, financial education will create sustainable economic growth, universal access to financial services and reduced income inequalities.

(*) According to goal 8.10 (SDG 8 - Economic Growth) issued by the United Nations, vision to 2030: Strengthen the capacity of domestic financial institutions to encourage and expand access to banking services , insurance and finance for everyone.

Zinance's vision:

Zinance aspires to become Vietnamese leading financial education platform for GenZ in 2027 by equipping them with essential financial knowledge to get closer to wealth and financial independence.

Mostly students (college, university, vocational, etc.) & workers. This group has limited income from part-time jobs and more allowance from parents or related sourceAmong Generation Z, our team focuses mostly on the age group 18-22 year olds because they have the biggest 'pain point' in terms of financial issues and related needs. Besides, the age group 23-26 is the second priority group because:

This group cares a lot about financial issues with the goal of stabilizing and increasing income

Set a premise for Zinance to expand the market in the future when approaching Millennials. Because this age group (23-26) possesses characteristics and personalities that are not too different for Gen Y’s files.

The detailed information regarding 2 groups is listed out below:

- 18-22: Mostly students (college, university, vocational, etc.) & workers. This group has limited income from part-time jobs and more allowance from parents or related source. This age group may not make much money but have high demand for spending, especially on eating out. and often find themselves living paycheck to paycheck. They also lack of knowledge about investing, can be easily target by defrauders

- 23-26: Students, fresh graduates, white collar, blue collar workers, etc. Has more stable/predictable income from jobs, less-non rely on parent allowance. They have high depression percentage due to income struggle, mental wellness. They also do not have enough knowledge on saving and investing (Vietnam is always in the Top 5 countries with a high level of optimism about the economic outlook, in the third quarter of 2017 it was ranked 5th globally.)

Our team members are mostly in Generation Z, notably the 18 to 22 age group. We are fully aware of those issues:

1. How financial problems affect our personal (and even familial) lives.

2. How important financial literacy is.

3. But most significantly, how difficult it is to acquire financial literacy due to a lack of support and available high-quality resources in our community.

- We conducted a deep-dive interview with 30 potential users at the early stage (before officially launching our first MVP) to test demand and user's pain points about related financial problems. 24/30 our interviewees affirmed that Zinance’s solution will solve their problems.

- We reached out to prestigious financial institutions and banks in Vietnam including MB Bank, MSB, TNEX, ACB, Cake by VPBank to test their demands on users who have financial literacy and other related problems; as a result; there are key insights that impact significantly on their fututure’s development:

- Many fake accounts

- High Churn rate after successfully acquire a new customers

- Few financial literate users

- They also reckoned that 100% of customers converted through Zinance platform are authentic and they have a strong demand on achieving customers who have financial literacy, and TNE (one of the financial institutions we interviewed) started processing short-term financial education courses to introduce and educate customers about their new service. -

- After launching MVP1, we conducted deep interviews with 50 Gen Z customers ( ~1 hour per interview) to define their financial situations, related financial problems, their financial goal and which points, function, service,etc. of our product could be improved. Combining with the feedback form, those feedbacks help us significantly on product's development and preparations for the Beta version of Zinance app.

- Improving financial and economic opportunities for all (Economic Prosperity)

- Pilot: An organization deploying a tested product, service, or business model in at least one community

1. Innovation in the idea

Help young people learn finance through gamification and learn-to-earn

→ a breakthrough in the way of education when most of the financial learning model is developed in the traditional class. The lesson system is broken down into small sections (bite-sized) and comprehensively covers financial topics

2. Innovation in business model

Zinance is not only an online education app but a platform providing users with financial services from financial institutions and other products/services from a wide range of industries.

3. Innovation in vision

Zinance's goal is to provide a comprehensive financial service that meets all of the needs of users while accessing financial services, specifically:

A platform to compare financial products and services

Zinance aims to be a platform that provides users with diverse products that fit their individual needs and budget by connecting and partnering with many different industries: e-commerce, travel-hotels,...

Personal Financial management platform

In order to expand the target market (to Millennials), Zinance aims to develop a financial management platform that helps users identify and realize personal financial goals, while enhancing and systemizing user's spending-investment plans.

What are your impact goals for the next year, and how will you achieve them?

We have planned to acquire 10.000 users by the end of 2023 and 2-3% conversion rate. It means that 10.000 Gen Z will achieve financial literacy (from basic levels) and approximately 2-300 users will use financial service from financial institutions and banks that helps them manage money better.

Besides, we also execute public and social media marketing campaigns to reach out to the community. Firstly, we will partner with and visit high schools and universities in Hanoi to organize programs that not only help students know for Zinance but understand the importance of financial literacy and how it impacts on their entire lives. We focus on high schools for gifted students and prestigious universities (our early target is 5 schools and 5 universities). Secondly, through social media marketing strategies, we create and develop financial education content through Tiktok and Facebook that helps the community, especially Gen Z, understand basic concept, knowledge about financial literacy.

Furthermore, we target to collaborate with 30 partners covering a wide range of industries such as education, financial institutions, e-commerce to offer users products, services regarding your demands that improves their lives in different ways.

We develop a free financial education app that helps gen Z learn financial literacy in a more effective and convenient way. We partner with a wide range of industries as our third parties including banks, financial and education institutions, e-commerce,etc. and offer users products/services during their learning’s process. Zinance uses affiliate marketing to convert users and receive commission for each successful conversion between users and third parties.

- Software and Mobile Applications

- Vietnam

Currently, we have served 100 users (through our MVP). This year, the people we serve will be divided into 2 groups: people using app and people we reach out through marketing campaigns (including on and off line formats). Regarding the first group, we have a target to achieve 10000 users this year, and 30000 people coming from our marketing campaigns, specifically 10000 from offline activities (by partnering with 5 high schools, and 5 universities in Hanoi city) and 20000 through online financial content on Tiktok, Facebook.

There are 2 main barriers currently exist for us to accomplish our goals in the next year.

1. Financial problems:

Regarding our business model, we will partner with third parties and offer users products, services from them, then receive commission for each successful conversion. It means that our business model is finance growth-oriented, we need enough user-bases to build prestige and attract third parties that requires a large initial capital, and it is not easy at this time owing to economic recession globally. In particular, now we own $17000 from the founders team, and we are calling for $50000 for this year's operation to achieve break-even point.

Here is the financial plan we have prepared for 5 years:

https://docs.google.com/spread...

2. Market education problems:

We consolidate the fragmented market including online education and financial education (two main problems we have tried to solve) and Zinance is an affiliate platform itself. The problem is that we have not specified (fragmented) demands from the market because users’ problems conjugate from both issues (online education and financial education) and it requires us to define problems in the MECE way (mutually exclusive, comprehensively exhaustive). Besides, using affiliate methods to generate revenue from a financial education app requires a thoughtful and subtle manner to orient (convert) users.

Currently, we have collaborated with 3 main partners:

1. VinUniversity:

Our university has constantly supported us during our development process, they provide us with $2000 initial funding, help us connect suitable mentors such as C-levels from successful startups, big corporation; experts and professors domestically and globally.

2. SIHUB EXPARA

After having been selected into the Sihub Expara Program, we received $10000 AWS Credit and training courses covering product, operation and fundraising subjects.

3. Finnovation

We are the Champion of Finnovation 2022 - the leading fintech startup competition in Vietnam. The organizers support us in recruiting suitable members to our team and consult us on important points regarding the business model and strategies.

Major Players:

Zinance

Gen Z customers: equipped with financial knowledge through a comprehensive, innovative, free learning platform

Banks, financial institutions (insurance , securities,...) and other industries: Promote current financial products and services; create a premise to expand and promote financial products to serve consumers in the future.

We are raising investment capital with a detailed financial plan going along with the business plan. All information is in this Pitch Deck: https://docs.google.com/presentation/d/1YGrnv87vD0tSHmOi4FcD97-2RGiMxm1_/edit#slide=id.g1b03c43ea6b_0_0